he Bank of Japan maintains the short-term interest rate target at 0 to 0.1 percent. In the statement, the Bank of Japan deleted the statement that it currently buys about 6 trillion yen of government bonds per month and said it would buy bonds according to the decision in March.

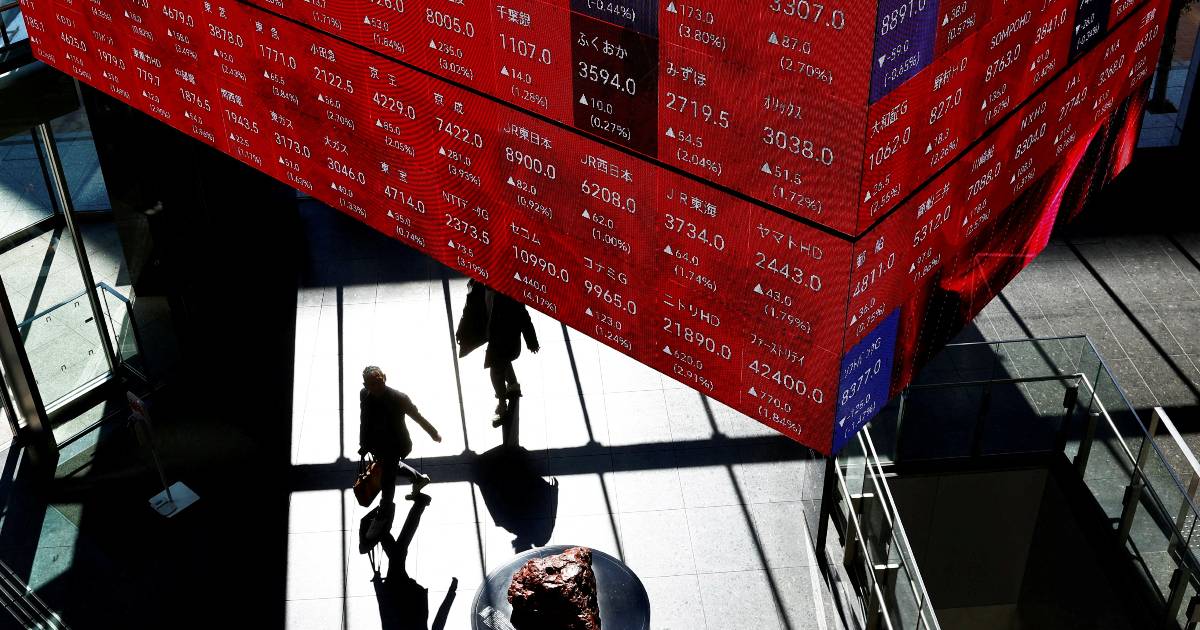

The Bank of Japan's Policy Board raised the median forecast of the core inflation rate in the 2024 fiscal year to 2.8%, higher than the 2.4% forecast in January; the forecast of the core inflation rate in the 2025 fiscal year was raised to 1.9%, higher than the 1.8% forecast in January; the forecast of the core inflation rate in the 2026 fiscal year remains at 1.9%.

The central bank said that it must closely monitor the fluctuations in the financial and foreign exchange markets and their impact on the Japanese economy and prices, and it is necessary to pay attention to the risk of large fluctuations in commodity prices brought about by geopolitical factors. Price risks include the future trend of the exchange rate and the trend of global commodity prices, as well as how they affect import prices and domestic prices.

The central bank said that the economic risks are largely balanced. Although there are some weaknesses, the Japanese economy has gently recovered, and inflation expectations have gently risen. After the interest rate decision was announced, the yen against the US dollar once fell to 156, reaching a 34-year low.